Understanding Increment Rebate (IR) Disbursement to Developers

Increment Rebates (previously referred to as Tax Increment Financing (TIF) are a unique tool available to local governments to promote economic development and community improvement. However, there are common misconceptions about how these rebates are disbursed to developers. In this article, we’ll demystify the process and provide a clear understanding of how Increment Rebates (IR)s work.

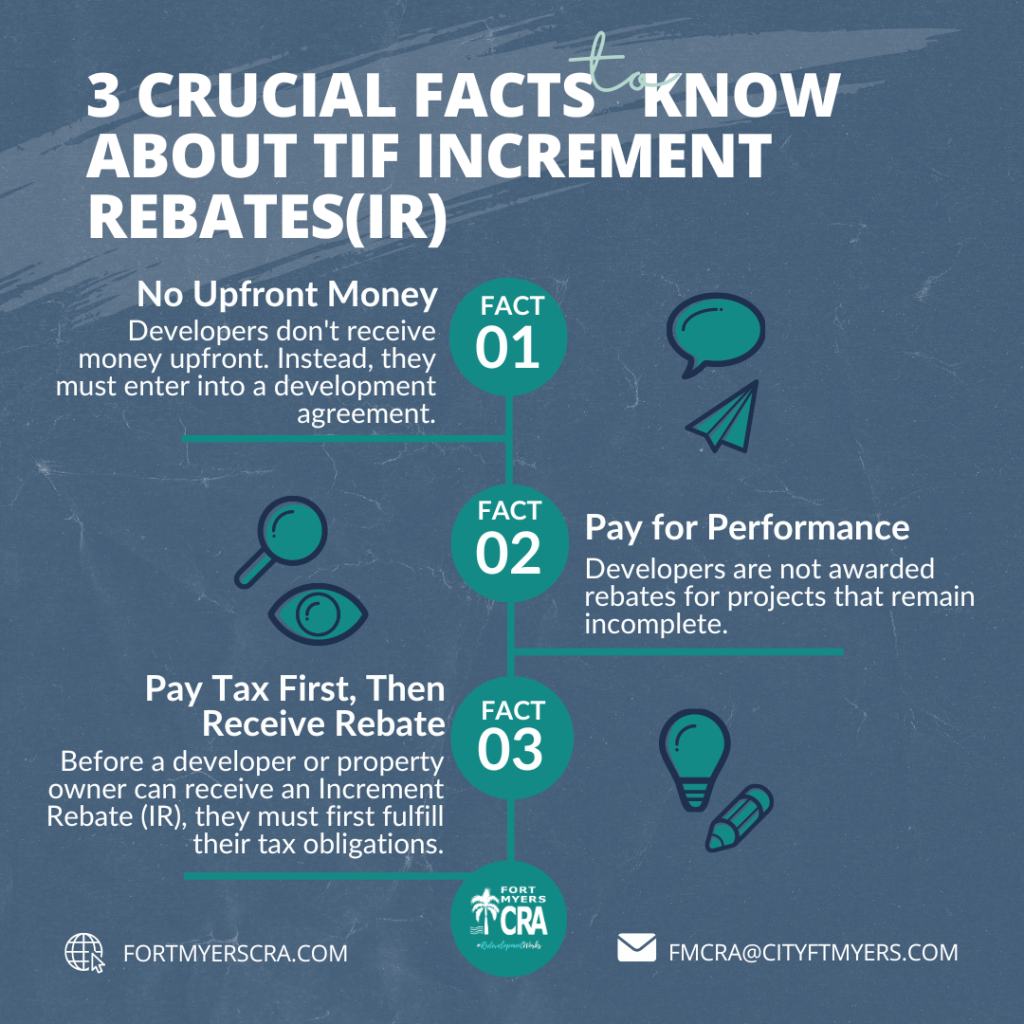

- No Upfront Money

One of the fundamental principles behind Increment Rebate (IR)s is that developers don’t receive money upfront. Instead, they must enter into a development agreement with the local government or the designated Community Redevelopment Agency (CRA).

Why is this the case?

This requirement ensures that developers have a clear plan and commitment to the project. It provides a structured framework within which the project is expected to be completed, ensuring that the local government’s objectives and expectations are met.

- Pay for Performance

Developers are not awarded rebates for projects that remain incomplete. The rebate mechanism operates on a “pay for performance” basis.

What does this mean?

This system ensures that developers are incentivized to complete their projects in a timely and satisfactory manner. Only upon the completion of the project, as outlined in the development agreement, will they be eligible for the rebate. This ties the financial incentive directly to the successful realization of the project, ensuring both the developer’s commitment and the delivery of community benefits.

- Pay Tax First, Then Receive Rebate

Before a developer or property owner can receive an Increment Rebate (IR), they must first fulfill their tax obligations. This means that they must pay their tax bill in full for the properties involved in the redevelopment project.

Why this requirement?

The essence of an Increment Rebate (IR) is to reimburse a portion of the increment in property taxes that results from increased property values due to redevelopment. By ensuring the tax is paid first, local governments guarantee that there’s a clear record of payment, and the rebate reflects a genuine increment above the baseline. This ensures transparency, fairness, and fiscal responsibility in the process.

Increment Rebates (IR)s are a powerful incentive for developers to undertake significant redevelopment projects that provide broad community benefits. However, the process is designed to ensure accountability, performance, and financial prudence. By understanding the nuances of Increment Rebate (IR) disbursement, stakeholders, from developers to taxpayers, can have confidence in the integrity and effectiveness of the system.

For developers eyeing Increment Rebates (IR)s as part of their project financing, adherence to these guidelines is crucial. Not only do they ensure eligibility for the rebate, but they also underscore the community partnership and shared objectives that make funded redevelopment projects a win-win for all involved.