The ABCs of Increment Revenue: A Simple Explanation

What is Increment Revenue?

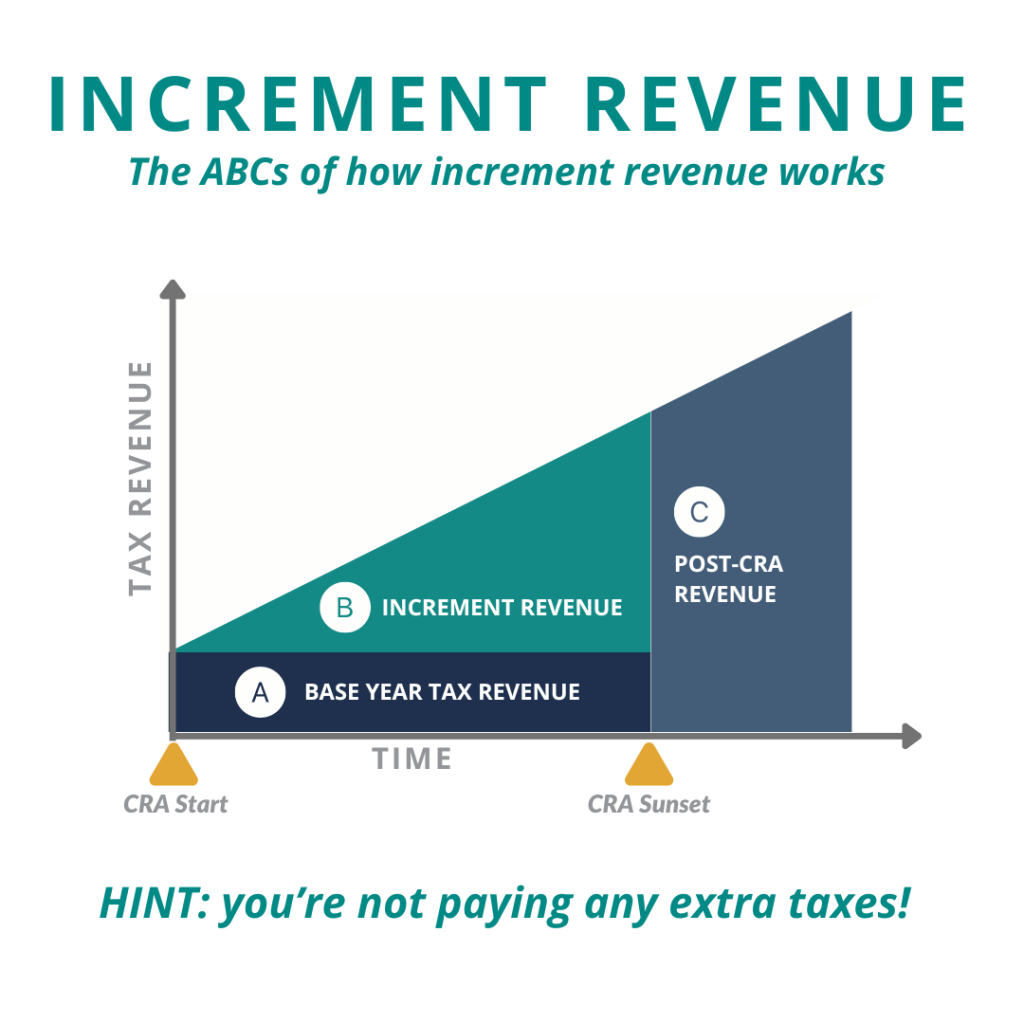

Increment revenue is a public financing tool used to revitalize specific areas within a community. It’s a way to capture the increased property tax revenue generated by new development and reinvest it back into that same area, formally known as Tax Increment Financing (TIF).

How Does Increment Revenue Work?

Think of it like this:

- Base Year: This is the amount of property taxes collected before any development occurs.

- Increment Revenue: When redevelopment or new development happens, the property values increase, leading to higher property taxes. This increase in tax revenue is the “increment.”

- Redevelopment Area: A designated area where targeted for revitalization.

- Redevelopment Trust: A special fund created to receive the increment revenue.

- Investment: The money in the redevelopment trust is used to fund improvements within the CRA area, such as new infrastructure, public amenities, or economic development initiatives.

Key Points to Remember:

- Increment revenue does not increase your individual property taxes. It only captures the increase in taxes due to new development.

- Increment revenue is a temporary tool. After a specified period, the CRA district is dissolved and sunsets. After the CRA sunsets all property taxes are returned to the city and county.

- Increment revenue has been used successfully in many communities to revitalize under-resourced and aging areas, attract new businesses, and improve the quality of life for residents.

Why Increment Revenue?

Increment revenue is a valuable tool for communities because it allows for:

- Targeted investment: Funds can be directed specifically to areas that need revitalization.

- Public-private partnerships: Increment revenue can encourage private development by providing incentives.

- Economic growth: By creating a more attractive environment for businesses, increment revenue can stimulate economic activity.

Want to learn more about what’s happening in your CRA? Contact Us.